Table Of Content

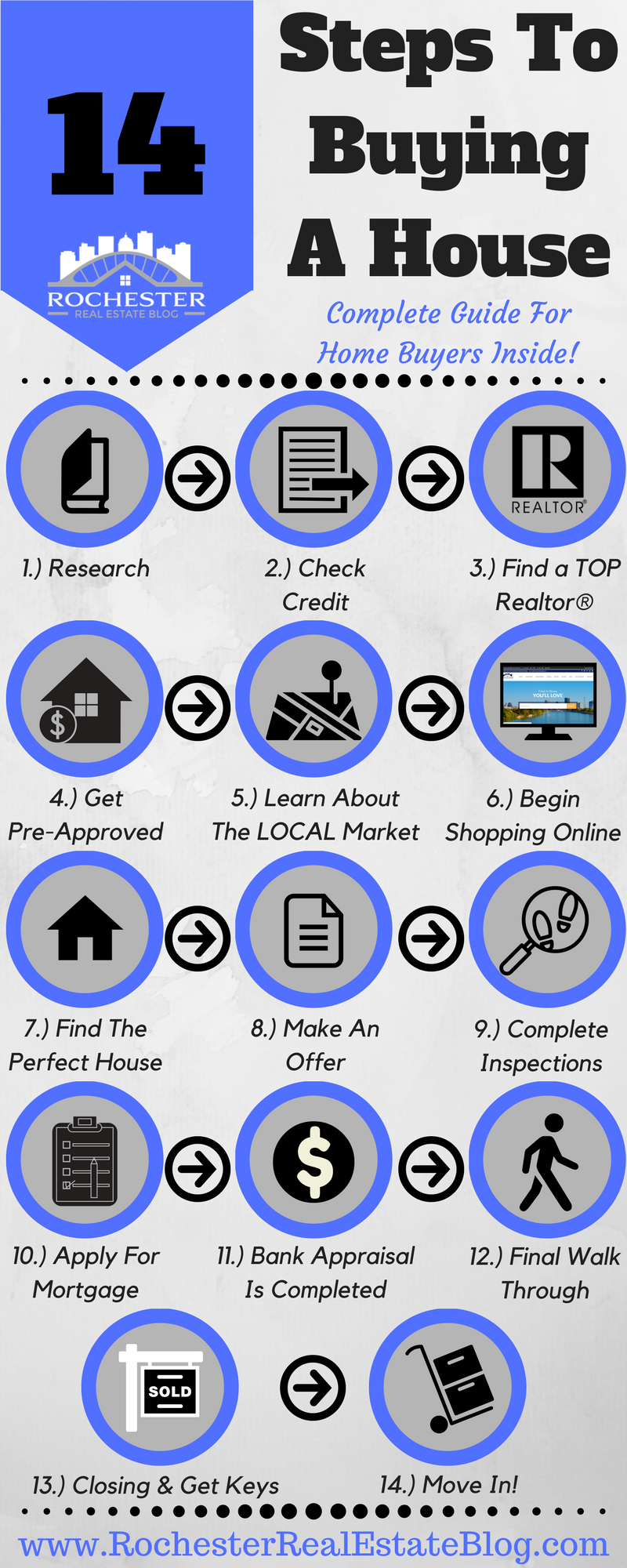

Before starting your search, be sure you understand the ins and outs of homebuying, so you can make the best decisions for your family — and your wallet. Here’s what to know when buying a house, one step at a time. On average, the length of time to buy a house from the start of the process to the time you move in takes from 5 – 6 months up to a year.

Buyer Guides

The higher your score, the lower the interest rate you will be eligible for — lower scores equate to more expensive mortgages. It’s common for home buyers to include a home inspection contingency in their purchase offer. A contingency gives buyers the option to back out of a purchase (or negotiate repairs) without losing their earnest money deposit if the home inspection reveals major issues. Make sure you see plenty of homes before deciding which property is right for you.

Home-buying readiness checklist

If you’re not clear on exactly what you want out of homeownership, you could end up regretting your choice. Victoria Araj is a Section Editor for Rocket Mortgage and held roles in mortgage banking, public relations and more in her 15+ years with the company. She holds a bachelor’s degree in journalism with an emphasis in political science from Michigan State University, and a master’s degree in public administration from the University of Michigan.

How to Get Out of Debt

Depending on the mortgage type you’re applying for, the DTI a lender is looking for will vary. Typically, for a conventional mortgage, a DTI of 50% or less is the benchmark – but many government-backed loans will have higher thresholds. The minimum credit score for a conventional loan is usually 620. For a government-backed loan, you’ll need a credit score of at least 580, but that can vary depending on which loan you choose. Referrals are often a good place to start; check with family and friends. Here’s more on how to find a real estate agent in your area.

Step 7: Begin House Hunting

Even if you got pre-approved for your home loan, your lender will want to conduct a home appraisal. This is where the lender checks out the house to make sure it’s a good investment. Since the sheer number of homes can become overwhelming, it’s best to separate your must-haves from those features you’d like, but don’t really need. Do you really want a new home or do you prefer a fixer-upper?

A mortgage lender can prequalify you to buy a house with a simple conversation about your income, assets and down payment. But getting prequalified isn’t the same as getting preapproved. Once you know how much you can afford to spend on your new home, stick to that amount. And if you’re buying a home with your spouse, make sure you’re both on the same page about your budget. You don’t want any surprises when it comes to saving for a down payment.

Buying a House for Sale by Owner - NerdWallet

Buying a House for Sale by Owner.

Posted: Mon, 26 Feb 2024 08:00:00 GMT [source]

That’s a smart question to ask before making one of the largest financial decisions of your life. Once you sign all the paperwork, it’s time to breathe a sigh of relief. The home-buying process may not be easy, but having a beautiful new home to call your own is worth it in the end. These real estate pros will help you reach your goals and focus on getting you the biggest bang for your buck in the home-buying process.

Hire a real estate agent.

Your real estate agent can tell you what’s common in your market. Your earnest money deposit goes toward your down payment and closing costs if you buy the home. If you agree to the home sale and later cancel, you’ll typically lose your deposit.

Questions To Ask A Mortgage Lender

Ideally, the mortgage payment on your new home shouldn’t exceed 28% to 31% of your gross monthly income. Your mortgage lender will calculate your debt-to-income ratio (DTI) to determine the maximum size of your loan. DTI measures how much of your gross monthly income you spend on debt.

If we do say so ourselves, realtor.com is a great place to start to figure out what properties are available in your area in your price range. Buyers can search by price, number of bedrooms, location, and other variables to start narrowing the options. Different mortgage shops offer a wide variety of rates and programs, so shop around to find the best rate and mortgage option for you. Chase's website and/or mobile terms, privacy and security policies don't apply to the site or app you're about to visit. Please review its terms, privacy and security policies to see how they apply to you. Chase isn’t responsible for (and doesn't provide) any products, services or content at this third-party site or app, except for products and services that explicitly carry the Chase name.

Make a mortgage payment, get info on your escrow, submit an insurance claim, request a payoff quote or sign in to your account. Go to Chase home equity services to manage your home equity account. All home lending products are subject to credit and property approval. Rates, program terms and conditions are subject to change without notice.

No comments:

Post a Comment